By Shelli Dawdy

Webster’s online dictionary provides some example phrases for some words. I find one of the examples for the word compromise, fascinating 1:

“To avoid an argument, always be ready to seek compromise.”

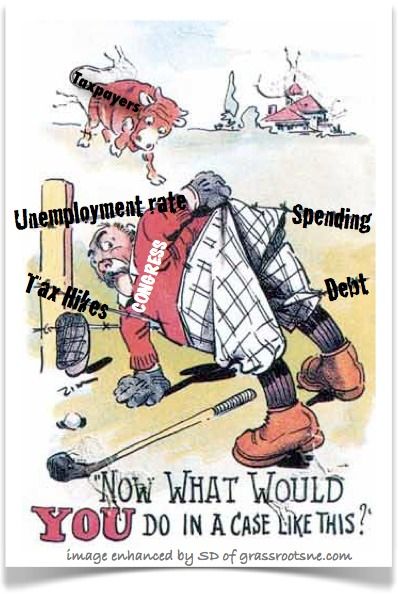

There’s no question we’ve heard a lot about bipartisanship and compromise. I’m not naive, compromise is of course, a necessary part of the legislating process, when government action is legitimately necessary. Bipartisanship would be a nice bonus. The word compromise now means we will have a terrific dog and pony show for a couple of weeks about some issue, and we’ll still spend hundreds of billions of dollars in a way that adds to our dangerously high deficit and we’ll accomplish absolutely nothing other than the growth of government size and power.

In American politics, the word compromise has been perverted beyond any significant meaning.

The word compromise does not apply to the deal Republicans made with President Obama regarding the Bush tax cuts, unless it is applied to mean that limited government, Constitutional principles were compromised, because they lost again.

The starting point of any negotiation is important. A need for compromise implies that the two parties involved are on diametrically opposed sides of an issue. In the case of the tax cuts, diameteric opposition would have required a significantly different position on the part of Republicans at the start.

Democrat leadership had the position that either leaving the Bush tax cuts in place or making them permanent for all tax brackets constitutes giving money that belongs to the government to the evil rich people. They also wanted to ensure that anyone with money or assets are taxed yet another time when they die by returning death tax levels to those of the pre-Bush era. The definition of rich both for the purposes of income and death taxation includes the majority of small business owners and many family farms. Democrats also want to extend unemployment benefits as long as possible when such benefits have already been extended to 99 weeks, and therefore continue the abysmally failing policy of paying people not to work.

Republicans entered this debate wanting to make the Bush tax cuts permanent for all brackets. The “ambitious plan” was simply to keep the status quo for taxation levels and to help stabilize the economy by removing the uncertainty that comes with temporary tax cuts.

Republicans are either so bad at negotiating it’s laughable or their desired final result actually included a death tax increase, continued uncertainty, and extension to unemployment benefits. Their calculations would have also included a convenient set-up for tax fight during the 2012 election. If they were genuinely interested in helping the economy, Republicans should have laid out initial terms that were more ambitious than their actually desired result to ensure there was something at least acceptable at the end of the process. As has become the norm for Republicans, when handed a significant mandate by voters and given an opportunity to govern, they are either not interested in using their own strength or clueless regarding how to put it to work. Despite all the dizzying spin from Democrat talking heads, President Obama was more than dented by the mid-term election results. He needs to do something about his bottoming out approval ratings.

Just what Republicans expected to accomplish by their very weak strategy is troubling enough to contemplate, but there’s more to be concerned about. The next question that should cause head scratching is the lack of recognition or a tactic agreement to a process for the “tax compromise” that would allow for many “sweeteners” to be added to the bill. “Sweeteners” is a beltway term for pork. Clear parameters should have been placed around the entire framework; tax cuts and only tax cuts should have been on the table. It’s quite clear that Republicans did not insist on any such thing. In addition to a double taxation death tax, an assurance that unemployment rates will stay as bad as they are or get even worse, and an economy that will likely remain unstable due to the uncertainty, the “tax cut compromise” has become an untenable $858 billion monstrosity that is larger than the odious 2008 bailout bill.

Another key question we should all ask ourselves: Is the status quo, in other words, our current tax system the one that will ensure economic growth? Does it conform with limited government, Constitutional principles? Is it just? The last time I checked, that status quo was part of a system that melted down and is currently being poorly propped up by the metaphorical equivalent of bubble gum and popsicle sticks (think bailouts, stimulus, and governmental interference). Of course, having those tax cuts go away would be a disaster for the economy at this point, but why didn’t the Republicans shoot for something that actually stands some chance of improving the economy dramatically?

The current federal income tax is a progressive system; at its core it means that government can pick winners and losers, can tax some people much more than others, and some people not at all. All Americans do not have skin in this game. Many of us are paying for the food (SNAP / food stamps), housing, medical care (Medicaid, SCHIPS), education, and general expenses (TANF), of people are who are not working at all and/or do not pay income taxes.

Why didn’t Republicans argue for moving to a flat tax system? Arguments in the flat tax’s favor run the gambit from inherent justice to the ability to cut a significant amount of costs by eliminating the majority of the IRS. As Heritage Foundation reported in 2005, a flat tax would require two simple postcard sized forms. Important note: The Heritage Foundation’s information on a flat tax is being given as it is a very well thought out explanation of how a flat tax would work. I do not favor their “revenue neutral” position on the flat tax, however. Revenue neutral presumes spending would stay at then-current levels, which is very wrong policy. Federal government size cannot be limited if spending levels are not severely curtailed. It is unlikely that Republicans would have won the argument on a flat tax, at this juncture, but for the class-warring Democrats, the alternative of making the current cuts permanent would have looked suddenly all the more palatable.

Besides making an argument for a flat tax, Republicans have failed to effectively take on the class warfare campaign launched by President Obama and followed up energetically by Democrats on a daily basis. Rather than beating a constant drum about the inherent immorality of taking money from some people and redistributing it to others, consistently attacking the notion that tax cuts are anything more than Americans’ keeping their hard-earned money and not a giveaway, and citing to what all sizes of businesses report they will do with their money based on what the short-fuse of two years will mean for business uncertainty, Republicans have chosen to focus on the death tax issue alone. Republicans could and should be citing facts about the history of tax cuts and how they have been followed by increased spending every time they’ve occurred since 1947.

To be continued tomorrow – refuting class warfare and the danger to US credit rating

- I also find another example given by Webster’s online dictionary for the word compromise fascinating, but for a different reason. There is actually a 2004 quote from Barack Obama. Perhaps this is simply a phenomenon of the internet age, but traditionally it seems like direct quotes, especially recent and from political figures are not appropriate fodder for dictionary sample phrases. ↩

You must be logged in to post a comment.