Apparently there are some Senators who don’t get that their position of advancing a liberal agenda is more than angering those who would be their base. Republicans of every stripe, from the “true blue” to Conservatives, tea party, limited government, pro-life, Libertarians and yes even the political “It girl” moderates HATE OBAMACARE.

Apparently there are some Senators who don’t get that their position of advancing a liberal agenda is more than angering those who would be their base. Republicans of every stripe, from the “true blue” to Conservatives, tea party, limited government, pro-life, Libertarians and yes even the political “It girl” moderates HATE OBAMACARE.

Let me say that again,your constituents and all of those who would/could be the “worker bees in 2014 HATE OBAMACARE. So how are YOU Senator going to explain to them that YOU voted to help implement Obama Care? Because what I am hearing from all of those groups is that “What is the difference between Republicans and Democrats?!” And if there is no difference why should I support, work my fanny off during a campaign or vote for someone simply becasue they have an “R” by their name?

And Senator what are YOU going to tell all your constituents who have lost their full time job to a less than 30 hour a week job so that their employee can avoid the business employer mandate of Obama Care? Or the consumers who will pay more for their goods and services as businesses are forced to pass their costs (taxes and fines) down to the consumer/voter?

Term limited Senate Majority Leader Randy RICHARDVILLE (R-Monroe) was quoted as saying said there’s a time constraint and said he hopes the legislation will be addressed this month before spring break.

“Come on Republicans, lets get er done for Obama Care!”

Really Senator?

And lobbyists like (The Michigan Chamber of Commerce, Small Business Association of Michigan (SBAM), Grand Rapids Area Chamber of Commerce, Michigan Manufacturing Association) have descended on the Capitol with their arguments of a SHORT TERM gain…more Federal dollars from an in debt and broke Federal government. And lets not forget its ALL our money, our tax dollars

Why should these organizations like lobby for Obama Care? Follow the Money

So the question is who will really benefit from Obamacare? A captive population forced to pay for a program that many never wanted?

Or those in the health care industry who have just been granted a monopoly and guaranteed income stream in perpetuity in return for campaign contributions, i.e., bribes, to Washington politicians? (Obamacare enforcement leads to IRS hires, less money for Medicare patients)

However, the reason that these lobbyists have put the squeeze on the Senate is becasue YOU have been effective calling/emailing/fax. And that is why WE NEED TO KEEP THE PRESSURE ON!

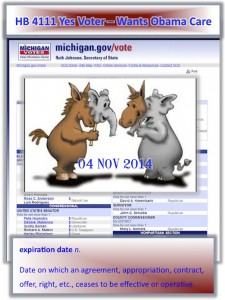

FIND YOUR SENATOR HERE AND e-mail ALL the Senators

Copy and paste email addresses for all GOP Senators

sendbooher@senate.michigan.gov,senjbrandenburg@senate.michigan.gov,

sentcasperson@senate.michigan.govsenbcaswell@senate.michigan.gov,

senpcolbeck@senate.michigan.gov,senjemmons@senate.michigan.gov,

senmgreen@senate.michigan.gov,senghansen@senate.michigan.gov,

sendhildenbrand@senate.michigan.govsenjhune@senate.michigan.gov,

senmjansen@senate.michigan.gov,senrjones@senate.michigan.gov,

senrkahn@senate.michigan.gov,senmkowall@senate.michigan.gov,

senjmarleau@senate.michigan.govsenameekhof@senate.michigan.gov,

senjmoolenaar@senate.michigan.gov,senmnofs@senate.michigan.gov

senjpappageorge@senate.michigan.gov,

senppavlov@senate.michigan.gov,senjproos@senate.michigan.gov

senrrichardville@senate.michigan.gov,

sendrobertson@senate.michigan.gov,sentrocca@senate.michigan.gov

sentschuitmaker@senate.michigan.gov,senhwalker@senate.michigan.gov

And here is a few FACTS to remind the Senators about the job killing Obama Care mandates and How Much Obama Care is going to Cost YOU! And that includes YOU Senator and your family.

IRS To Employers: Pay ObamaCare ‘Shared Responsibility’ Or Else

“As the IRS warned on December 28, “The Treasury Department and the IRS are aware of various structures being considered under which employers might use temporary staffing agencies (or other staffing agencies)… to evade application of section 4980H [the employer insurance mandate].”

So Obama rams through a costly, onerous, time-consuming and job-killing health insurance bill, and employers will look for ways to limit or minimize its impact—just as rich liberals do with taxes. And the IRS expects it, which is why it’s putting employers on notice….

Section 4980H is in the IRS 144-page notice of “proposed regulations providing guidance under section 4980H of the Internal Revenue Code … with respect to the shared responsibility for employers regarding employee health coverage.”

Notice 2011- 36

The definition of full-time employee is key in determining whether and, if so, to what

extent, an employer may incur § 4980H(a) liability or § 4980H(b) liability.

Section 4980H(c)(4) provides that a full-time employee with respect to any month

is an employee who is employed on average at least 30 hours of service per week. An

applicable large employer with respect to a calendar year is defined in section

4980H(c)(2) as an employer who employed an average of at least 50 full-time

employees on business days during the preceding calendar year.

For purposes of determining whether an employer is an applicable large employer, full-time equivalent employees (FTEs), which are determined based on the hours of service of employees who are not full-time, are taken into account.

In general, § 4980H treats, with respect employee who has an average of at least 30 hours of service per week as a full-time employee.

So how are companies of 50 employee or more responding? Cutting full time to less than 30 hours AND/OR and passing the other taxes/costs associated with Obama Care mandates

A few examples…

Michigan Company Stryker (Big Obama supporter) formerly http://bigstory.ap.org/article/donors-dollars-top-5-fundraisers-obama Corporation (medical devise co.) has announced that it will close its facility in Orchard Park, New York, eliminating 96 jobs next month. It will also counter the medical device tax in Obamacare by eliminating 5% of their global workforce, an estimated 1,170 positions. (Although they may think they can make it up with the Medicaid expansion)

Affordable Care Act Tax Provisions (A whole bunch of taxes and taxpayer paid Subsidies)

Medical Device Excise Tax

On Dec. 5, 2012, the IRS and the Treasury Department issued final regulations on the new 2.3-percent medical device excise tax (IRC §4191) that manufacturers and importers will pay on their sales of certain medical devices starting in 2013. On Dec. 5, 2012, the IRS and the Treasury Department also issued Notice 2012-77, which provides interim guidance on certain issues related to the medical device excise tax. Additional information is available on the Medical Device Excise Tax page and Medical Device Excise Tax FAQs (archived link) on IRS.gov.

Florida based restaurant boss John Metz, who runs approximately 40 Denny’s and owns the Hurricane Grill & Wings franchise (formerly/http://www.gadailynews.com/news/national/145553-denny-s-to-charge-5-obamacare-surcharge-and-cut-employee-hours-to-deal-with-cost-of-legislation.html)has decided to offset that by adding a five percent surcharge to customers’ bills and will reduce his employees’ hours.

Red Lobster and Olive Garden parent company may rely on more part-time workers.

Papa John’s formerly CEO plans to slash workers’ hours so he doesn’t have to cover them.

Applebee’s New York CEO says he’ll ax jobs because of Obamacare.

Cedar Falls formerly cutting part-time workers’ hours to avoid health care mandates. City officials say layoffs would be needed without cut in hours

Health care law brings double dose of trouble for CCAC part-time profs

To Community College of Allegheny County’s president, Alex Johnson, cutting hours for some 400 temporary part-time workers to avoid providing health insurance coverage for them under the impending Affordable Health Care Act is purely a cost-saving measure at a time the college faces a funding reduction

Lake County council formerly/http://posttrib.suntimes.com/news/lake/16251917-418/lake-county-council-looks-to-cut-part-time-workers-insurance.html looks to cut part-time workers’ insurance

“Any added costs are going to have to be passed on,” said Mike Ruffer, a Five Guys franchise holder with eight of the popular restaurants in the Raleigh-Durham, N.C. area. He will need all the profits from at least one of his eight outlets just to cover his estimated added $60,000-a year in new Obamacare costs.

What’s more, he’s iced plans to build another three restaurants until after the administration explains the exact rules and penalties employers will face. The law’s plan to have those available March 1 has been pushed back to October.

And while we are at it “How Much Obama Care Going to Cost YOU?”

(YOUR) Individual Shared Responsibility Provision (THIS is what Justice Roberts calls a Tax)

Starting in 2014, the Individual Shared Responsibility provision calls for each individual to either have minimum essential health coverage (minimum essential coverage) for each month, qualify for an exemption, or make a payment when filing his or her federal income tax return. On Jan. 30, 2013, the Treasury Department and the IRS issued (archived link) on the Individual Shared Responsibility provision. Comments may be submitted electronically, by mail or hand delivered to the IRS. For additional information on the Individual Shared Responsibility provision and the proposed regulations, see our questions and answers. Additional information on exemptions and minimum essential coverage is available in proposed regulations issued by the U.S. Department of Health & Human Services.

OR PAY A TAX!

The monthly penalty amount for a month is equal to 1/12 of the greater of the following amounts: (1) the flat dollar amount or (2) the percentage of income. The flat dollar amount is the lesser of the following amounts: (a) the sum of the applicable dollar amounts for all nonexempt individuals without minimum essential coverage for whom the taxpayer is liable or (b) 300 percent of the applicable dollar amount. The applicable dollar amount is $95 for 2014, $325 for 2015, and $695 for 2016, and will be increased for calendar years beginning after 2016 by a cost-of-living adjustment. If a nonexempt individual has not attained the age of 18 as of the beginning of a month, the applicable dollar amount for that individual is one-half of the regular applicable dollar amount. The percentage of income is calculated as the excess of the taxpayer’s household income over the taxpayer’s Federal income tax return filing threshold under section 6012(a)(1), multiplied by a percentage figure. The percentage figure is 1percent for taxable years beginning in 2014,2 percent for taxable years beginning in 2015, and 2.5 percent for taxable years beginning after 2015

“In most cases, taxpayers will file their tax returns reporting their health insurance coverage, and-or making a payment, and there will be no need for further interactions with the IRS,” Miller said.

You must be logged in to post a comment.